Dec 1, 2022

Timothy J. Baio

Less than 2% of most applicants get into incubators, and it’s worse for accelerators:

First, what’s the difference?

Accelerators put you in the club AND invest in you, while incubators simply put you in the club. Obviously, if you are founding a startup, you’d prefer to get welcomed into the club and get a nice check to start making your dream come true. However, incubators can also have value.

What they bring…

Both formats give you a wonderful community of other founders, experts and approved vendors to select and begin your journey. Both also connect you with angel or seed investors and guide your journey through legal, pitching, MVPs and more.

What they take…

Incubators take time, Accelerators take equity and time. Accelerators invest in your startup and plan to participate in future investment rounds if you reach the next level. Arguably, the most successful accelerator, YCombinator, makes a significant cash contribution. Somewhere over $500k is invested to formulate concept, design, build, launch, market and make it through to initial revenues and the next investment round. It’s good work, if you can get it. But less than 0.5% of applicants do. Incubators typically don’t make an investment, but there are some hybrids who make small investments to help you pay your rent, hire legal services or build your MVP.

The downside to incubators…

Incubators are nice with respect to ‘community’. There are salaried staff members welcoming you, guiding you, introducing you to other founders, hosting informative online conferences, and connecting you with experts in legal, marketing, pitching and more. The problem is they don’t actually do anything. Okay, I’m sure they work hard and know a lot, but from the founder’s perspective, the founder must do all the lifting. Incubators are teachers, giving you assignments. You still have to hire the resources to concept, design, build and launch the MVP, and then pitch and close an investment.

For many founders who have no idea where to start, this is an enticing offer. Their programs typically last 3-6 months, and in the end, the participant hopes to have an investor who helps them build a real product. In summary, if you get into an incubator (less than a 2% chance) and have 3- 6 months, and are lucky enough to engage investors, it can be a good way to go. You’ll meet many people, and also follow best practices. However, you’re still ‘hell and gone’ from a real product and the ‘proof of concept’ investors love to see before they’ll be involved. Even so-called ‘pre-seed’ investors will invest in a proven product before an idea, any day of the week. And given the choice between one investment ‘proven’ and one that isn’t, they chose the proven product every time, even if they say they are ‘pre-seed’.

The problem with Accelerators…

This is simple… YOU CAN’T GET IN!.Thousands apply, wait, apply, wait, interview, wait, and then 50 startups make it out of 1,000 applicants. Another issue is that participation does not guarantee success. Thousands of startups don’t make it through the program or continue on after graduation (about 400 exits out of 4,000 investments). It is always a feather in the founders cap, yes, and they are more likely to raise money than a non-accelerated company, but plenty fail. There are some other issues too, they tend to take only companies who they see as potentially monstrous ‘unicorns’. These are startups they believe will be the next AirBnB, DoorDash or Coinbase. If you want to be a $100 million company, sorry, they’ll pass. And now there’s data suggesting dreaming too big, and taking massive amounts of investment to dominate the world, may be a ticket for failure.

Hybrids…

There are a blend of the two partnerships that give you a little money in exchange for equity and run you through their community, connect you with mentors, and help you use the money to subsidize your income and build an MVP. This might be great for someone just out of college, but for a real business person who needs to continue working while the startup materializes, or a small startup, that needs a real product launched in 6 months, this can be just a waste of 4-5 months. They are still not doing the work.

Some other things, they don’t tell you…

Accelerators tend to place a big value on the ‘team’. They might not admit it, but they love highly educated, corporate experienced people with impressive resumes. They also love people who have sold a company before. Whereas, incubators will take in a raw entrepreneur, someone in school or a regular ‘Joe’, but less so for accelerators. They value major university education and well-known corporate experience. I’m not saying this is right or wrong, but know this, if you have an idea that’s out of your professional wheelhouse. They like to pretend they would have invested in Jobs and Waz, but I highly doubt the guys would have made it past the approval committee. Incubators are more likely to take you, as they have no equity or use grant money to help you along. They also have you on as a member for longer, sometimes a year or more. But for many, this is a waste of time when they don’t get funded through the incubator’s partner network.

Here are some questions to ask yourself to help determine if you should apply to either an incubator or accelerator:

1. Do you want to take 3-6 months to apply and another 3-6 months to produce an MVP?

2. Do you need the community they will connect you with?

3. Do you absolutely need the money an accelerator would bring? (of course it would be nice)

4. Do you have the industry resume and education to make it past an accelerator approval committee? (less so for an incubator)

5. Do you have a billion dollar idea or a nice multi-million dollar idea?

6. Do you mind giving up the equity (about 5% without a monetary investment)?

7. Do you mind giving up the equity (about 15% with a monetary investment) ?

8. Do you have the time (before you get a salary) to perform (or lead) all the work they ask you to do?

You can consider a partner studio like Freshify:

We exist to help startups concept, design, create, launch, market and fundraise for flexible fees. We feel too many founders need a reliable partner to guide them through each step but cannot find one. There are so many tricks and traps they will fall into without an experienced studio and partnership team working through a proven process. This ensures the startup has the best chance for success. Yes, the startup is paying, but they’re going faster, building more and ensuring success far better than another startup trying to find what they need through applications to incubators or accelerators.

Here are some additional articles you may want to take a look at:

Startups Avant | Best Startup Accelerators

UNC – Kenan Flaglier | Do Accelerators Really Work?

Harvard Business Review | What Startup Accelerators Really Do

Mass Challenge | Accelerators vs. Incubators

Fast Company | Microsoft is bringing Windows and Teams to Meta’s Quest VR headsets

Micro Ventures Blog | Accelerators vs. Incubators: What’s the Difference?

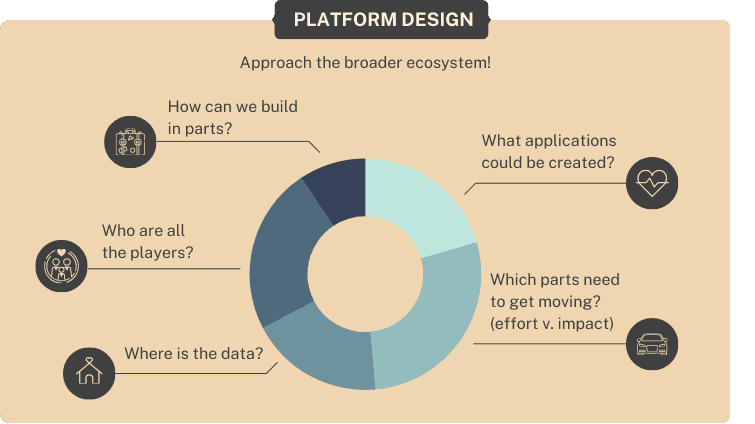

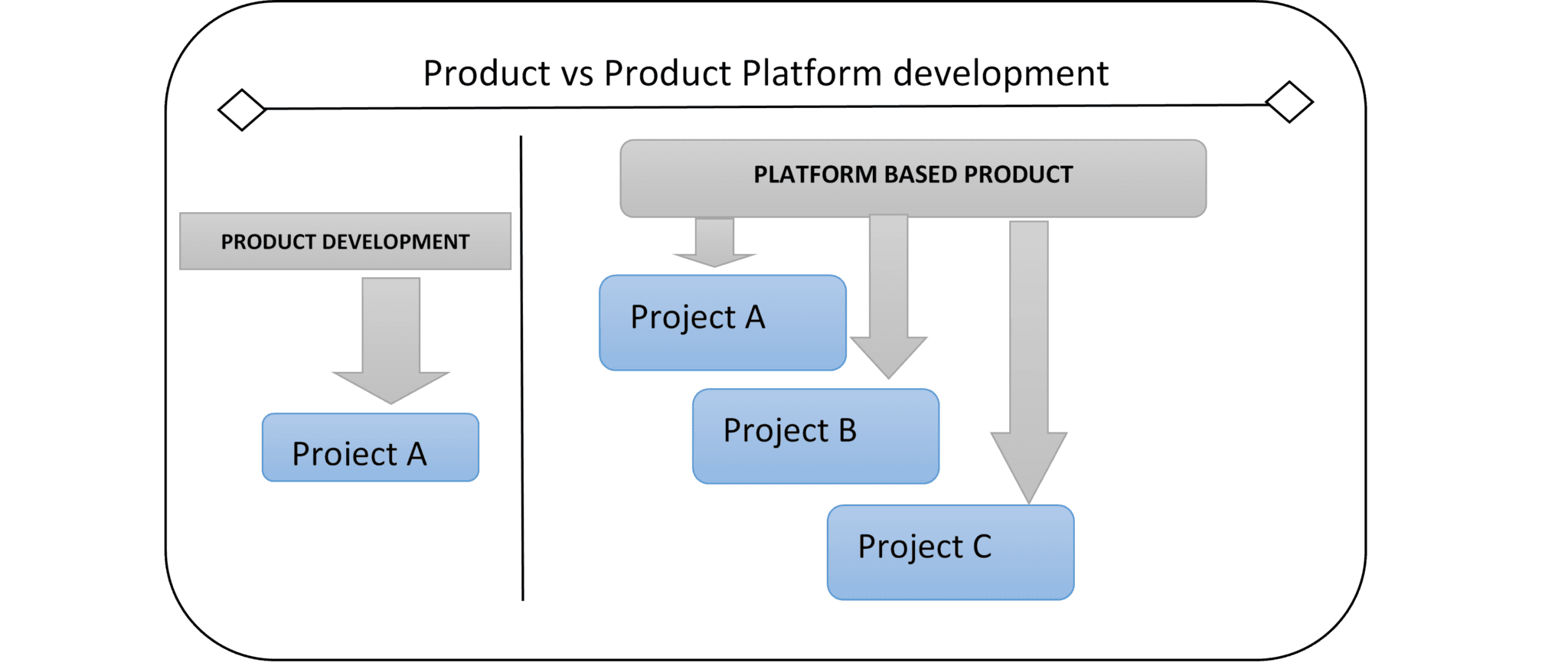

Begin innovating with a “Platform as a Product” mindset.

“Platform as a Product” is an engineering, organizational concept, and design-thinking approach...

Read more

Aug 19, 2024

The Role of Venture Studios in the Startup Ecosystem

Venture studios are a new and innovative way to incubate and launch successful startups. But what....

Read more

Aug 19, 2024

Read More