Jul 12, 2023

Mark Bench

In the rapidly evolving world of finance, the integration of Artificial Intelligence (AI) has become a game-changer, unlocking a wealth of opportunities and addressing some of the industry’s most pressing challenges. As Fintech companies strive to stay ahead of the curve, they are increasingly turning to AI-powered solutions to enhance their operations, improve customer experiences, and drive innovation.

1. Fraud Detection and Cybersecurity:

One of the most significant applications of AI in Fintech is in the realm of fraud detection and cybersecurity. AI algorithms can analyze vast volumes of transaction data in real-time, identifying suspicious patterns and anomalies that may indicate fraudulent activities. By learning from past fraud cases, these AI-powered systems can continuously improve their detection accuracy, reducing the risk of false positives and protecting both Fintech companies and their customers.

Moreover, AI is playing a crucial role in strengthening cybersecurity measures. AI-based solutions can detect and prevent cyber threats, such as hacking attempts, malware, and data breaches, helping Fintech organizations safeguard their sensitive financial data and maintain the trust of their clients.

2. Personalized Financial Advice and Wealth Management:

AI-powered robo-advisors are revolutionizing the way Fintech companies provide personalized financial advice and wealth management services. By analyzing customer data, market trends, and economic factors, these AI-driven solutions can generate customized investment strategies and recommendations tailored to an individual’s financial goals, risk tolerance, and investment preferences. This level of personalization not only enhances the customer experience but also empowers individuals to make more informed financial decisions.

Furthermore, AI can automate various wealth management tasks, such as asset allocation, portfolio rebalancing, and tax optimization, freeing up human financial advisors to focus on more complex financial planning and client relationships.

3. Predictive Analytics and Risk Management:

AI models can delve into vast datasets to uncover patterns, trends, and correlations that can significantly improve risk assessment and management in the Fintech industry. By leveraging predictive analytics, Fintech companies can make more informed decisions in areas such as credit risk assessment, loan underwriting, and portfolio optimization.

These AI-powered insights can help Fintech organizations better understand and manage their risks, ultimately enhancing their overall financial stability and resilience.

4. Conversational Banking and Customer Service:

AI-powered chatbots and virtual assistants are transforming the customer service landscape in Fintech. These intelligent systems can provide 24/7 support, answering customer queries, processing transactions, and even offering personalized financial advice. By leveraging natural language processing (NLP) and natural language generation (NLG), these conversational AI solutions can engage with customers in a more natural and intuitive manner, improving the overall customer experience and reducing the need for human intervention.

5. Process Automation and Operational Efficiency:

AI can automate a wide range of back-office and administrative tasks in Fintech, such as data entry, document processing, and compliance reporting. This robotic process automation (RPA) not only improves operational efficiency but also reduces the risk of human errors, freeing up valuable resources for more strategic and value-added activities.

Moreover, AI can optimize resource allocation, workflow management, and decision-making processes within Fintech organizations, further enhancing their operational effectiveness and profitability.

While the integration of AI in Fintech offers numerous advantages, it is essential to address the potential challenges and drawbacks. Ethical and regulatory concerns, technological complexity, and the need for talent and trust-building are some of the key considerations that Fintech companies must navigate.

As the Fintech industry continues to evolve, the role of AI will only become more prominent. By embracing this transformative technology, Fintech companies can unlock new possibilities, enhance customer experiences, improve operational efficiency, and stay ahead of the competition in the ever-changing financial landscape.

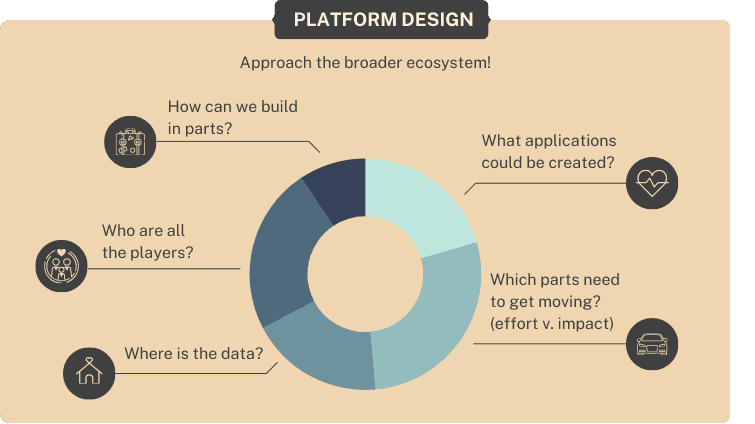

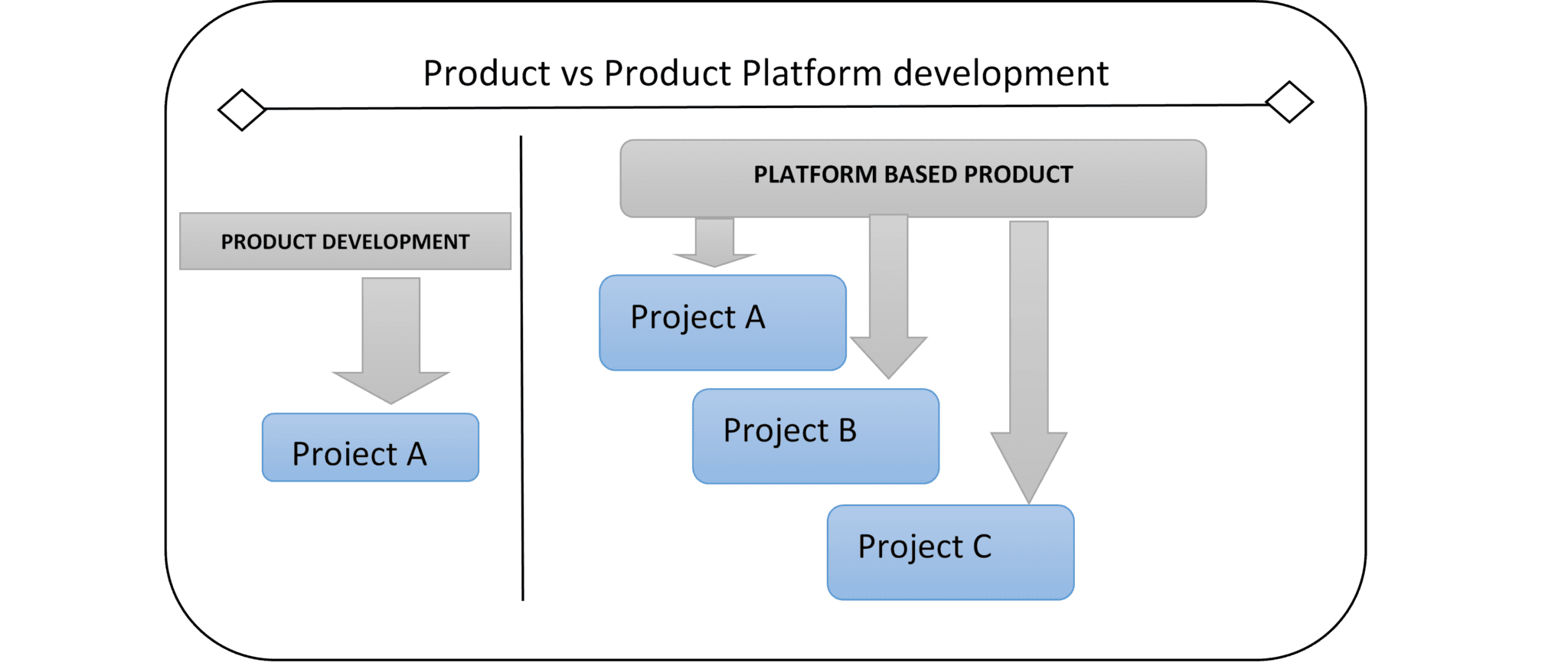

Begin innovating with a “Platform as a Product” mindset.

“Platform as a Product” is an engineering, organizational concept, and design-thinking approach...

Read more

Aug 19, 2024

The Role of Venture Studios in the Startup Ecosystem

Venture studios are a new and innovative way to incubate and launch successful startups. But what....

Read more

Aug 19, 2024

Read More